If you’re in the mortgage business, you know there’s always at least one major challenge facing the industry. Some years, it’s high interest rates or high market demand with low inventory.

This year, the challenging combination we are seeing is rising interest rates + low inventory with sky-high customer experience expectations from home buyers.

Whatever challenge you’re facing, smart technology investment can help you come out ahead.

One of the smartest technology investments you can make for your mortgage business is adopting a customer relationship management (CRM) tool or platform.

The right mortgage CRM will streamline your operations and improve everything from lead management and marketing to loan applications and borrower follow-up.

Fortunately, there are lots of mortgage CRMs available. Unfortunately, it’s not always easy to sift through the wildly enthusiastic marketing messaging and figure out which one is actually right for your business.

We work with mortgage businesses every day, and we’ve seen just about all there is to see when it comes to mortgage CRMs. In this article, we’ll provide an overview of four of the most popular options, plus share some practical insights based on our experience.

A Closer Look at 4 Popular Mortgage CRMs

Mortgage CRM marketers are good at their jobs. The website for every mortgage CRM claims to be “exactly what you need” or “the #1 mortgage CRM on the market.”

The truth is that all mortgage CRMs promise to do the same basic things, including:

- Improve lead management

- Boost Sales efficiency & performance

- Speed up loan applications, processing & approval

- Enable personalized marketing

- Improve customer data organization & access

- Facilitate customer updates, follow-up & relationship nurturing

Each tool has different features to help you achieve these results; some are more effective than others at delivering these outcomes.

Some tools work great for very small companies but are difficult and expensive to scale as you grow. There are solutions that work well for some mortgage lines of business but are a complete disaster for others.

Some mortgage CRMs are fantastic – but only if you don’t want to customize anything. And others have low entry price points but hidden fees and costs that add up quickly over time.

For this article, we’ve done our best to summarize the most relevant features, strengths, and weaknesses of the four mortgage CRM solutions we encounter most frequently:

-

Jungo

-

Encompass CRM

-

BNTouch

-

Salesforce

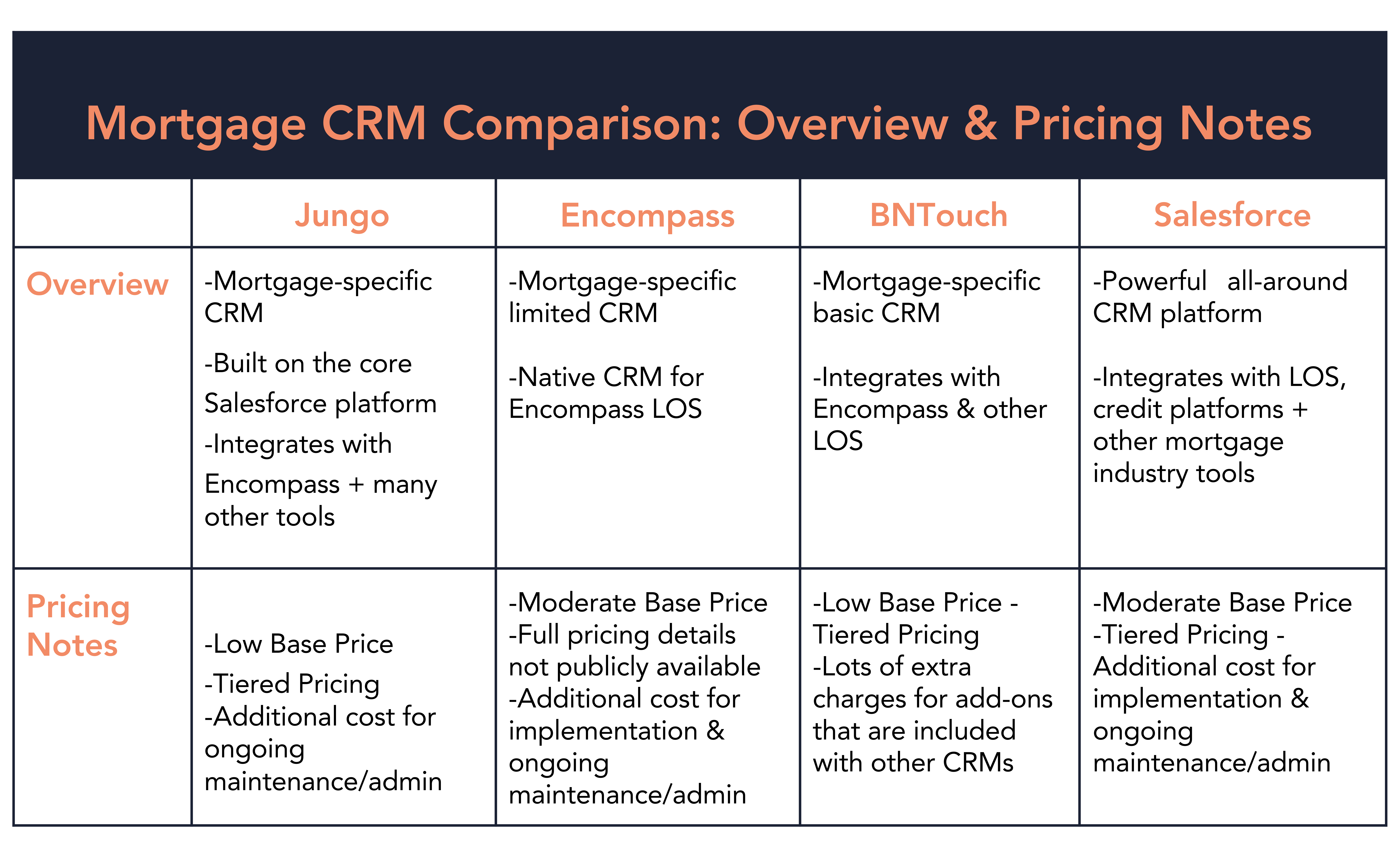

Let’s start with some brief overview notes + pricing comparisons.

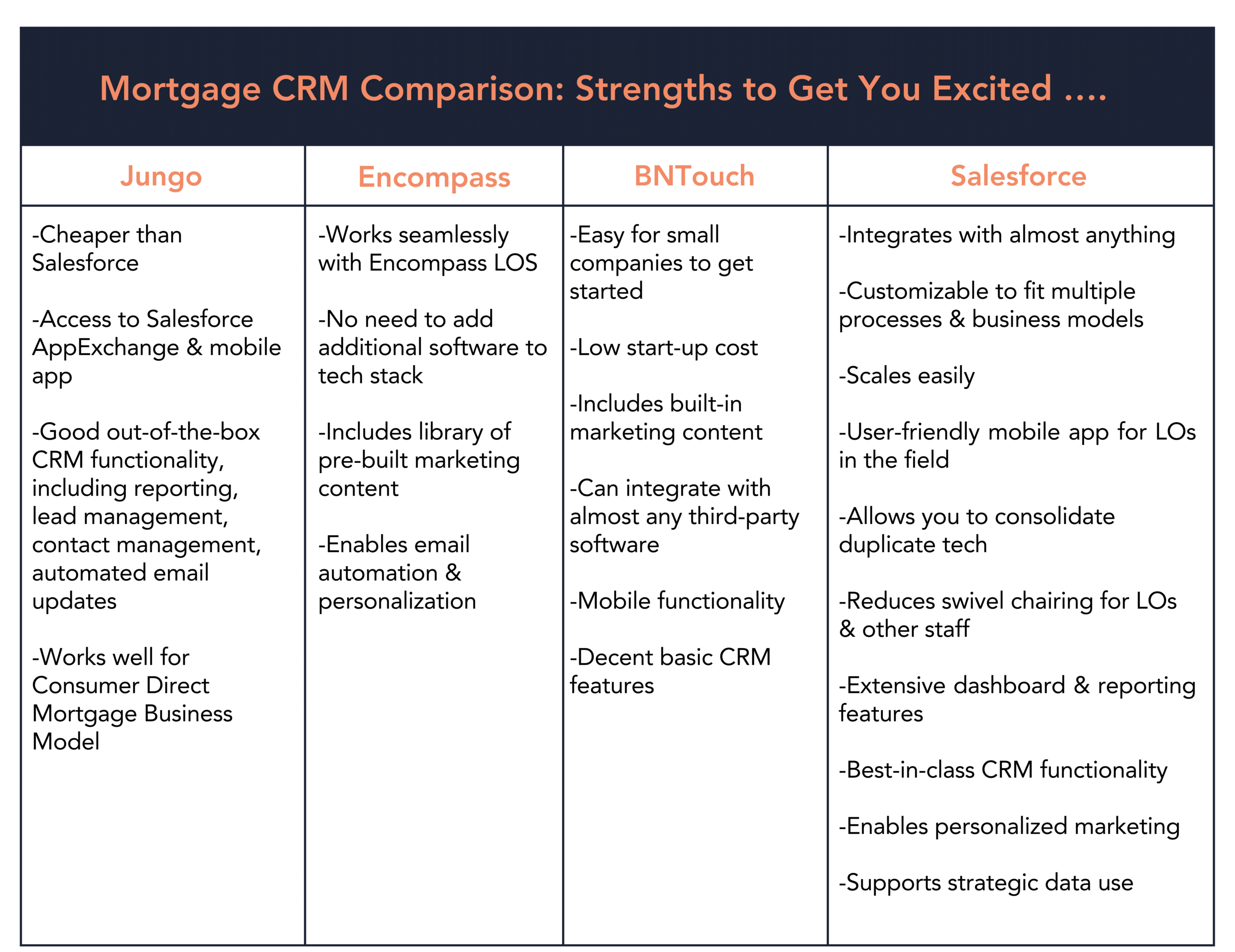

Now let’s take a look at what each solution does well.

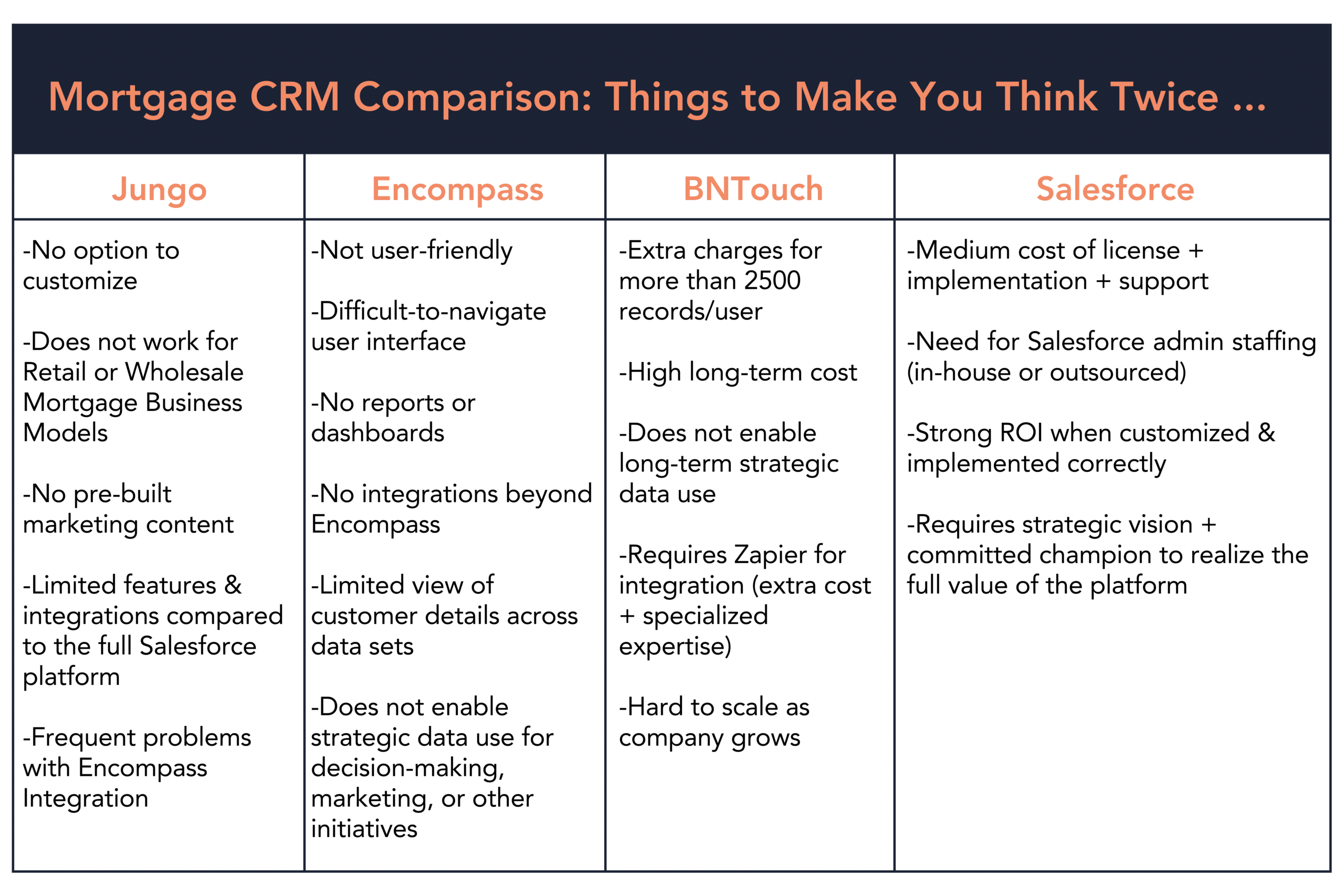

All four mortgage CRM tools have impressive features and benefits, but no tool is perfect. Our final comparison table highlights some not-so-exciting factors you should consider before making your final decision.

Mortgage CRMs in Real Life: Observations from Platinum Cubed’s Experience

Full disclosure: Platinum Cubed is a Salesforce partner. We work with real estate and financial services businesses – including mortgage lenders and brokers – to implement, develop, and maintain Salesforce.

We’ve helped dozens of mortgage companies achieve outstanding results using Salesforce, and we believe that, when properly implemented and maintained, Salesforce is the best mortgage CRM on the market.

With that said, we interact with a lot of mortgage companies who are using (or considering) a variety of CRM solutions, meaning we’ve built up a broad base of knowledge and practical experience.

We’ll wrap up this article by sharing a few observations based on that experience:

- If you have less than ten employees, you’re not ready to implement Salesforce. You should start with another tool and plan to upgrade when you’ve grown enough to support the cost and generate a higher ROI.

- The Jungo integration with Encompass is a major source of frustration for many users. We do a lot of Jungo replacements because people get frustrated with the frequent malfunctions that cause data to go missing or show up in the wrong fields.

- We covered this in the comparison table, but it’s worth emphasizing: Jungo ONLY works for consumer direct mortgage business models. We also do a fair number of Jungo replacements for retail and wholesale mortgage companies who discover that Jungo does not meet their needs.

- Encompass CRM is convenient for customers who already use Encompass LOS, but many users outgrow it and decide to implement Salesforce. The most common reason users give for making the switch is that Encompass’s lack of dashboards, marketing capabilities, and reporting makes it hard to use data to create value in a strategic way.

Questions? We’re Always Happy to Talk

We hope you’ve found this article helpful. If you have any questions about Salesforce – or about mortgage CRMs in general, feel free to reach out! We’re always happy to talk, answer questions, and help people understand how technology like mortgage CRMs can power better business outcomes.

Contact Platinum Cubed